Tax Services

We provide a wide variety of tax services for our clients. From simple individual tax form preparation to complicated business tax planning, licensing & requirements from the numerous federal and state agencies which regulate business and commerce, Andersen CPA has you covered. Just let us know what you are looking for:

Business

- Partnerships

- Corporations

- LLC’s

- Business Tax Planning

Individual

- Individual Tax Preparation

- Individual Tax Planning

Miscellaneous Tax Services

- Business Licenses

- Sales Tax

- Payroll Tax

- Property Tax

Contact Andersen CPA today at 818-225-8022 or Bruce@Andersencpa.com to discuss your Individual or Business tax, accounting, or financial services needs.

Articles Related to Tax Services

Business Income Tax Year End Tax Letter – 2023

The following are some strategies we should consider for reducing your business's taxes for [...]

Individual Income Tax Year End Tax Letter – 2023

The following are some of the tax breaks from which you may benefit, as [...]

A new IRS directive… To ERC or Not to ERC, that is the question.

Posted 10/26/23 As with other government programs during the pandemic, the IRS Employee Retention [...]

Business Taxes for 2023: Various Tax Deadlines

Here are a wide variety of general tax matters, from property taxes to income [...]

Business Income Tax Year End Tax Letter – 2022

As the year draws to a close, it's important that we discuss any year-end [...]

Individual Income Tax Year End Tax Letter – 2022

Here are some year-end tax strategies to help minimize taxable income on your Individual [...]

Hey, please cut the IRS some slack…

…they are doing the best they can… REALLY? Wow, how time flies. We are [...]

2022 Tax-Related Dates – Income Tax Due Dates

I wanted to provide some key dates for the income tax season. S-Corporations, LLCs [...]

Educator deduction for COVID-19 PPE

Posted by the IRS on February 4, 2021 This new IRS ruling has not [...]

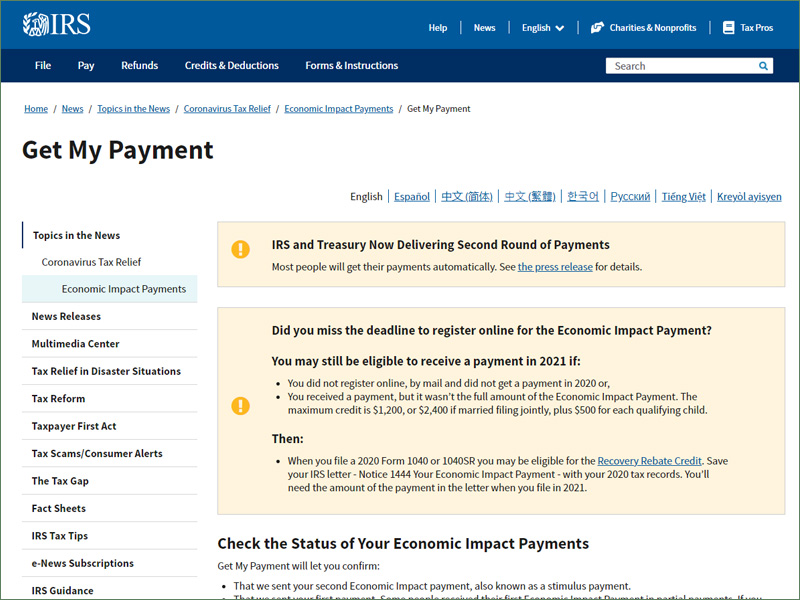

Economic Impact Payments on their way; visit IRS.gov instead of calling

This is an official notification from the IRS. New stimulus payments are on their [...]

COVID-19 Tax-Relevant Information

The coronavirus is impacting the deadlines for income tax filings in 2020. How the [...]

Code Section 179 Expense Deduction

https://www.youtube.com/watch?v=MlysSaz7ZPY Code section 179 allows for equipment, primarily, to be written off in the [...]

Windows 10 Installation & Initial Impressions

Windows 10 is the next big thing for Microsoft. It is the answer to [...]

So you think you have a rental property?

Five factors were identified by the Tax Court to help in this classification for [...]

Form 3115 Repair Regs Brief

10/10 Rule for Small business relief from Repair Regulations The IRS provides relief from [...]

Attention Business Owners who Haven’t Filed 2012 Tax Returns

If you haven't filed your 2012 tax return, check your mailbox for a new [...]

IRS Operations During Government Shutdown

The following article was taken from the IRS website where it was originally published [...]

Improvements to Qualified Real Estate Property Can Be Written off in ONE YEAR!

Usually, the “Section 179” tax code provision is thought of with assets such as [...]

A quick update on the status of the IRS and its collection activities

The IRS has had its budget slashed by Congress, and has, among other things, [...]

5 Tips if Your Name Has Changed (IRS Tax Tips for 2013)

This is information directly from the IRS. In summary, every name change needs to [...]

2012 American Taxpayer Relief Act & What it Means For Business

2012 American Taxpayer Relief Act – Businesses Here is a nice digest of the [...]

2012 IRS Nationwide Tax Forums – 6 City Tour

This year's IRS Tax Forum has been announced. There are six cities from which [...]

Eight Facts on Penalties For Filing Late Tax Returns – Tax Year 2012

Eight Facts on Penalties For Filing Late Tax Returns - Tax Year 2012 When it [...]

Requirements for Federal Tax Return Preparers – Presented by the Return Preparer Office

Requirements for Federal Tax Return Preparers Presented by theReturn Preparer OfficeDate: March 30, 2011Time: [...]

Request for Public Comment on Plan for Retrospective Analysis of Significant Regulations

The EEOC is beginning a new, periodic retrospective review of its existing significant regulations [...]

Florida-based company with locations nationwide agrees to pay more than $754,000 in overtime back wages following US Labor Department investigation

Temporary supervisors misclassified under Fair Labor Standards Act MAITLAND, Fla. — Beck Disaster Recovery [...]

Revenues Sink 2% at Top 100 Firms

(The Accounting Today Top 100 Firms, 2011 edition) So, when’s the rebound? The revenue [...]

Seven Tips About Rental Income and Expenses

IRS Tax Tip 2011-45, March 4, 2011 Do you rent property to others? If [...]

Enron Whistleblower Scores $1.1M Reward from IRS

Accounting Today Magazine Online, Washington, D.C. (March 15, 2011); Written By: Michael Cohn The Internal [...]

Jury Awards over $1.5 Million in EEOC Sexual Harassment and Retaliation Case Against Mid-American Specialties

MEMPHIS, Tenn. A U.S. District Court jury brought in a verdict of over $1.5 [...]

More Households Move into Higher Tax Brackets

As first read on Accounting Today Magazine, Online Ed. New York (March 14, 2011), [...]

U.S. Equal Employment Opportunity Commission (EEOC) – to Meet Tuesday on Employment of People with Mental Disabilities

PRESS RELEASE3-10-11 http://www.eeoc.gov/eeoc/newsroom/release/3-10-11.cfm WASHINGTON – The U.S. Equal Employment Opportunity Commission (EEOC) will hold [...]

Accountants Can Promote Taxpayer Savings Through Savings Bonds

Originally posted on the Intuit ProAdvisor Newsletter – February 23rd, 2011, by Intuit Staff An exciting [...]

Rebel Without a Cause: Prisoner denied Earned Income Credit

The following is an article in the March edition of the Nat'l Association of Tax Professionals, TAXPRO [...]

Physical Injury Settlement No Form 1099-MISC filing required

The following is an article in theFebruary edition of the NATP TAXPRO Monthly: Antonio Chappell was injured [...]

Obama Proposes Extending Small Business Tax Cuts Permanently

As first reported on Accounting Today online Washington, D.C. (January 31, 2011) by Michael [...]

Jackson Hewitt Sues H&R Block over Ads

Parsippany, N.J. (January 31, 2011)by Michael CohnJackson Hewitt Tax Service filed a lawsuit Monday [...]

EITC – Don’t Overlook It – IRS Tax Tip 2011-20, January 28, 2011

As reported on : http://www.irs.gov/newsroom/article/0,,id=106429,00.html IRS Tax Tip 2011-20, January 28, 2011 The Earned [...]

Payroll Tax Cut to Boost Take-Home Pay for Most Workers; New Withholding Details Now Available on IRS.gov

Payroll Tax Cut to Boost Take-Home Pay for Most Workers; New Withholding Details Now Available [...]

New 1099 Reporting in 2011 for Rental Property

Starting January 1, 2011, if you get a 1099 for rental income, you will [...]

Buy Small Business Stock: Gain Can Be Tax Free!

Qualified small business stock may be a great buy between now and the end [...]

First-Time Homebuyer Credit – 2009 – Extended and Enhanced

First-time homebuyer credit is a huge benefit in 2009 compared to the credit for 2008.

To Incorporate or not to incorporate?: that is the question.

Choosing the correct business form can be a difficult task. As a CPA, I [...]

2010 Year End Tax Planning – Businesses

If you are like most businesses, your year-end is December. That gives you a month [...]

Fake IRS Notice – “Unreported / Underreported Income”

Please take note of this: I have been getting these for almost a month, [...]

If I have off-shore money, can the IRS take all of my money?

August 28, 2009 – If I have off-shore money, can the IRS take all [...]